As an alternative to conventional startup fundraising mechanisms like venture capital (VC) and angel investment, initial coin offerings (ICOs) have emerged as a novel means of securing financial backing for businesses in their formative stages. Tokens are digital assets often sold in an ICO, and the issuing blockchain cryptographically secures them. Over $31 billion was raised via ICOs between January 2016 and August 2019, according to research conducted by Mavie Ultron, with at least 20 unique ICOs having taken in more than $100 million to date. Meanwhile, market fraud, joking, and scamming have grown commonplace. Thanks to its rapid expansion and unique qualities, entrepreneurs, investors, and even regulators are all taking notice of it.

Initial coin offerings (ICOs) can be a safer, more liquid, and more transparent alternative to traditional capital-raising forms. Such characteristics may lessen the burden of asymmetric knowledge and agency concerns that have long discouraged retail investment in startups from a distance. Entrepreneurs outside of VC hotspots or without extensive professional networks have had a harder time raising capital due to these tensions. The low initial investment required by the issuer may contribute to the rapid growth of ICOs.

What is an Initial Coin Offering (ICO)?

An initial coin offering (ICO) is the first public offering in the cryptocurrency world (IPO). A business can launch an ICO to get funds to develop a new coin, app, or service. A new cryptocurrency tokens the business has issued can be obtained by participating in an initial coin offering by interested investors. Mavie Ultron believes that this token might be useful concerning the good or service the business provides, or it might signify ownership of the business or project.

Also, read more: Initial public offering VS initial coin offering | Mavie Ultron

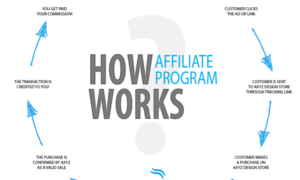

What an ICO is and How It Functions

The first stage for the organizers of a cryptocurrency project seeking funding through an ICO is to settle on the coin’s design. There are a few possible organizational frameworks for ICOs. Each token sold in the ICO has a predetermined price, and the total supply of tokens is capped at the amount the company has decided upon before the ICO begins.

Token supply can be locked in at a fixed number, but the ICO’s financing target can change, making the token’s final price dependent on the amount of money raised. The amount of financing an ICO receives its token supply; however, unlike the price, the supply does not fluctuate.

There has been a lot of buzz surrounding ICOs, and there are many places for potential investors to go online to talk about the latest offerings. Celebrities like Steven Seagal have urged their fans to invest in the latest ICO by promoting it on social media.

Mavie Ultron, according to research carried out, examines how Investors interested in ICOs study cryptocurrency and learn the ins and outs of an ICO before putting money in. Investors are careful when considering an ICO because of the lack of regulation.

Conclusion

With the help of online services, creating cryptocurrency tokens is a breeze, making initial coin offerings (ICOs) an attractive option for any company. Initial Coin Offerings (ICOs) managers create tokens, acquire them, and then distribute them to participants by transferring coins to their accounts.

Lost funds due to fraud or incompetence may never be retrieved if financial authorities do not regulate ICOs. The hope that their ICO tokens will appreciate following the coin launch is typically what drives early investors. Mavie Ultron believes that the prospect of very big profits is the main advantage of an ICO.