Blood Glucose Monitoring Devices have many advantages for diabetic patients and the medical staff caring for them (BGMD). BGMD is becoming regarded as a crucial element of intensive diabetes treatment. Diabetic individuals can easily and conveniently assess their blood sugar levels wherever they are in just a few minutes.

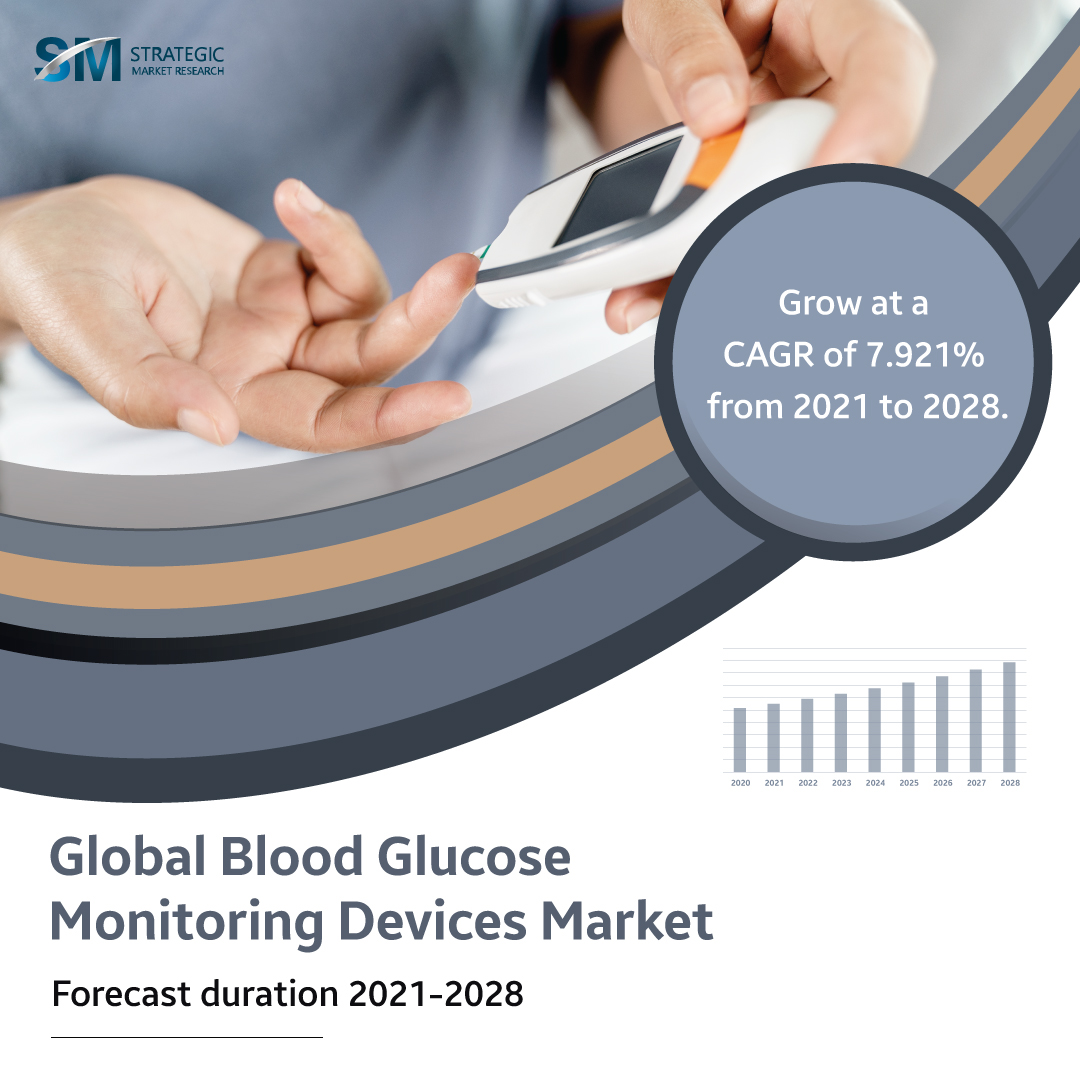

The market worth of blood glucose monitoring devices in 2021 was USD 14.48 billion and will reach USD 28.75 billion by 2030, growing at a 7.9% CAGR during 2021-2030.

Continuous glucose monitoring (CGM) devices aid in real-time, continuous analysis of blood glucose levels. Additionally, it aids patients in deciding on their insulin dosage and nutritional intake. Additional factors, including sedentary lifestyles, which include eating fast food, drinking alcohol, and smoking, and a rise in demand for safer and quicker diagnostics will boost market expansion throughout the projection period.

Market Dynamics

The major factor boosting the demand for blood glucose monitoring devices is an increasing population of diabetes patients worldwide. The largest factor in the sharp increase in diabetes cases is the aging population, which is more vulnerable to the disease. The World Health Organization predicts that the world’s aging population will expand rapidly from 12% in 2015 to 22% by 2050. Additionally, a rise in sedentary lifestyle patterns, followed by harmful behaviors like smoking, drinking alcohol, and eating unhealthily, is directly contributing to an increase in diabetes rates around the world. The market is primarily driven by the rapidly expanding geriatric population and ongoing advancements in blood glucose monitoring technology.

To gain the greatest market share, the top manufacturers are primarily concentrating on technological advancements in blood glucose monitoring devices. Diabetes patients are encouraged to choose more sophisticated monitoring equipment due to the simple accessibility of reimbursement for self-monitoring of blood glucose (SMBG) and the growing importance of frequently checking their blood glucose levels. Recent improvements in monitoring technologies have made monitoring simpler, more practical, and less expensive. The diagnosis, management, and monitoring of diabetes all involve the use of blood glucose monitoring equipment. The global market for blood glucose monitoring devices will grow as these devices are increasingly used to treat diabetes. Inadequate reimbursement, high application costs for CGM systems, and product recalls are a few main barriers to this market’s expansion.

Market Segmentation

On the basis of product, the market for blood glucose monitoring devices is segmented into self-monitoring devices and continuous blood glucose monitoring devices.

Because of their simplicity of use and low cost and self-monitoring, blood glucose monitors held the largest market with 65.11% of the revenue share in 2021. SMBG is a crucial element of diabetes care. It is further segmented into lancets, testing strips, and blood glucose meters. Due to its widespread usage and low cost, the testing strip category had the greatest revenue share in 2021.

On the basis of application, the market for blood glucose monitoring is segmented into type 2 diabetes and type 1 diabetes.

With a market share of 89.2%, the Type 2 diabetes market segment led the blood glucose monitoring devices market. Type 2 diabetes often causes the majority of diabetes cases. According to the National Library of Medicine, type 2 diabetes incidence will continue to rise throughout the world, reaching 7079 cases per 100,000 people by the end of 2030.

By end-user, the market for blood glucose monitoring is segmented into home care, hospitals, and diagnostics centers.

The hospital sector had the highest revenue share of over 40.0% in 2021 as a result of expanding infrastructure and rising healthcare costs in hospitals. Additionally, BGM devices are increasingly utilized in outpatient and inpatient hospital settings due to the accurate data they deliver to practitioners and the improvement in patient quality of life.

Regionally, the market for blood glucose monitoring is divided into Europe, North America, Asia-Pacific, and LAMEA.

North America Contributed to the maximum market position with 35.0% of the share in 2021 due to its well-established healthcare infrastructure. The rising prevalence of obesity, high treatment costs, technological developments, and new product launches drive the regional market. Due to the growing population of elderly people, more likely to develop diabetes, Europe will hold a sizable revenue share during the projected period. Additionally, the region’s demand for BGMs is growing as a result of advancements in the healthcare industry and the adoption of cutting-edge medical technologies.

Key Players

- Nipro

- Sanofi

- Medtronic

- B. Braun Melsungen

- Arkray

- Ypsomed

- Abbott Laboratories

- F. Hoffmann-La Roche

- Prodigy Diabetes Care

- Ascensia Diabetes Care

- Acon Laboratories

- Nova BiomedicalLifescan

- Dexcom

The market worth of blood glucose monitoring devices in 2021 was USD 14.48 billion and will reach USD 28.75 billion by 2030, growing at a 7.9% CAGR during 2021-2030. The main factors accelerating the market expansion for blood glucose monitoring devices are the rapid pace of technological advancement and the early detection of hypoglycemia and hyperglycemia.